is keeper tax safe

You can even look for a paperless solution to store all your tax records electronically. Thats 0585 for the first half of 2022 and 0625 for the.

Keeper Tax Review Find Expenses That Qualify For Deductions

You are safe as far as it has a transparent view of all your income and expenses.

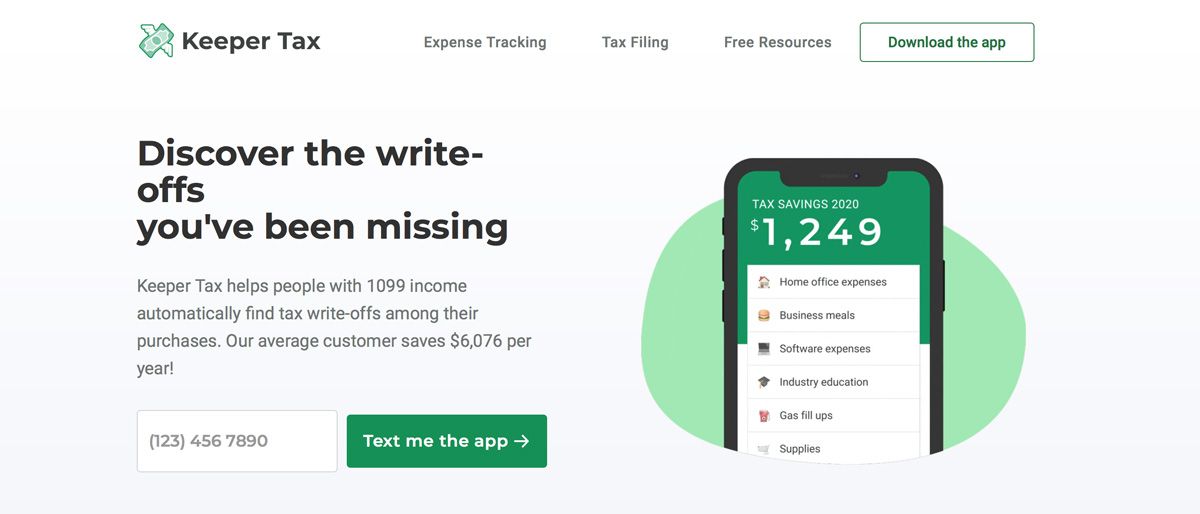

. Keeper Tax automatically finds write-offs for freelancers saving them thousands of dollars in taxes per year. For those who still use paper money from time to time Keeper Tax also allows users to track purchase they make in cash as well. A hands-off business-expense tracking suite and an optional tax preparation solution that can help you.

To do this simply select the add. I hired them again and they did a great job with that too. Should you decide to file your taxes with Keeper Tax youll pay 89 for both federal and state returns.

Tax software for gig workers. Ad They did an excellent job. She saved over 2056 in 2020.

Because it uses zero-knowledge encryption and 256-bit AES encryption your data and passwords are only accessible only by. Keeper FAQ Is the Keeper app safe. Widely considered a rising contender in the tax and accounting software industry it raised a 15 million Series A led by venture capital group.

Keeper Tax is a user-friendly Android or iOS app with two core features. With Keeper Tax she no longer has to do anything. Have been using Keepertax for a year now and it is so darn easy and user friendly I dont even know what to say.

The service connects to your bank or card to automatically track business expenses. Keeper Tax is trusted safe and legitimate. Keeper Tax helps independent contractors and freelancers discover tax.

Review real professional profiles see prior experience and compare prices in one place. Was using a different app prior and. On average people find 1249 in tax deductions the first 90 seconds of using Keeper Tax.

Learn to handle tax season with confidence for free. Alternatively you can obtain your records for 39 and do your taxes. The mileage deduction is calculated by multiplying your yearly business miles by the IRSs standard mileage rate.

Were hiring a software engineer to own one of our key business. W19 Active Consumer Fintech. She just sends a text back to her personal virtual bookkeeper and she recoreds deductions.

Our interactive tools and expert-written guides make taxes easy for freelancers and 1099 contractors.

Keeper Never Miss A Write Off Reviews Product Hunt

Keeper Tax Reviews Will Keeper Tax Help You Maximize Tax Deductions

Keeper Tax Review Find Expenses That Qualify For Deductions

Honest Keeper Tax Review 2021 My Experience Jae Nichelle Ghostwriting Services

Honest Keeper Tax Review 2021 My Experience Jae Nichelle Ghostwriting Services

Keeper Tax Review Find Expenses That Qualify For Deductions

Top 22 1099 Tax Deductions And A Free Tool To Find Your Write Offs

Honest Keeper Tax Review 2021 My Experience Jae Nichelle Ghostwriting Services

Keeper Tax Reviews Will Keeper Tax Help You Maximize Tax Deductions

Keeper Never Miss A Write Off Reviews Product Hunt

Plastic Fishing Hook Secure Keeper Holder Lure Accessories Jig Hooks Safe Keeping For Fishing Rod In 2022 Fishing Rod Rod Fishing Tools

Keeper Tax Review For Freelancers September 2022 Finder Com

Keeper Tax Review A Look At How It Works

The Credit Wellness Checklist Everyone Needs To Use Checklist Lexington Law Finances Money

Honest Keeper Tax Review 2021 My Experience Jae Nichelle Ghostwriting Services

Honest Keeper Tax Review 2021 My Experience Jae Nichelle Ghostwriting Services